Investment and Treasury

A low VAT rate provides resources for the improvement

of quality and competitiveness of tourism products

and services. In a highly globalised tourism market,

not only price but also the quality of the offer

matters. High tax burdens, especially a high rate of

VAT, tends entrepreneurs to keep prices competitive,

thus withholding investments into renovation and

improvement of the quality of the offer.

Besides price competition in the global tourism market, a competitive price-performance ratio is of utmost

importance as well for attracting visitors. This ratio can be improved either by price reduction or by the

improvement of the offer, for which, however, financial resources are indispensable. Such resources can be more

available, when e.g. low VAT rates relieve entrepreneurs from fiscal pressure and thus leaving more manoeuvre

to invest in the performance of the services.

The example of

Germany

and the VAT reduction of 2010 for accommodation services demonstrates, how much

low VAT rates can contribute to increased investments into the sector and thus increasing its performance.

Where on average hotels in Germany were investing around 90.000 Euros in their establishment in 2009, this

figure increased to 119 and more importantly to 243.000 in the years 2010 and 2011, respectively. 2011 marked

also the year, when more was invested than depreciated, putting an end to a period of the overall deterioration

of assets. Investments were done mainly to the acquisition of machinery and equipment as well as in the

renovation and modernisation of guest rooms.

32

These measures resulted in Germany in an improved price-

performance ratio compared to the years prior to the VAT reduction.

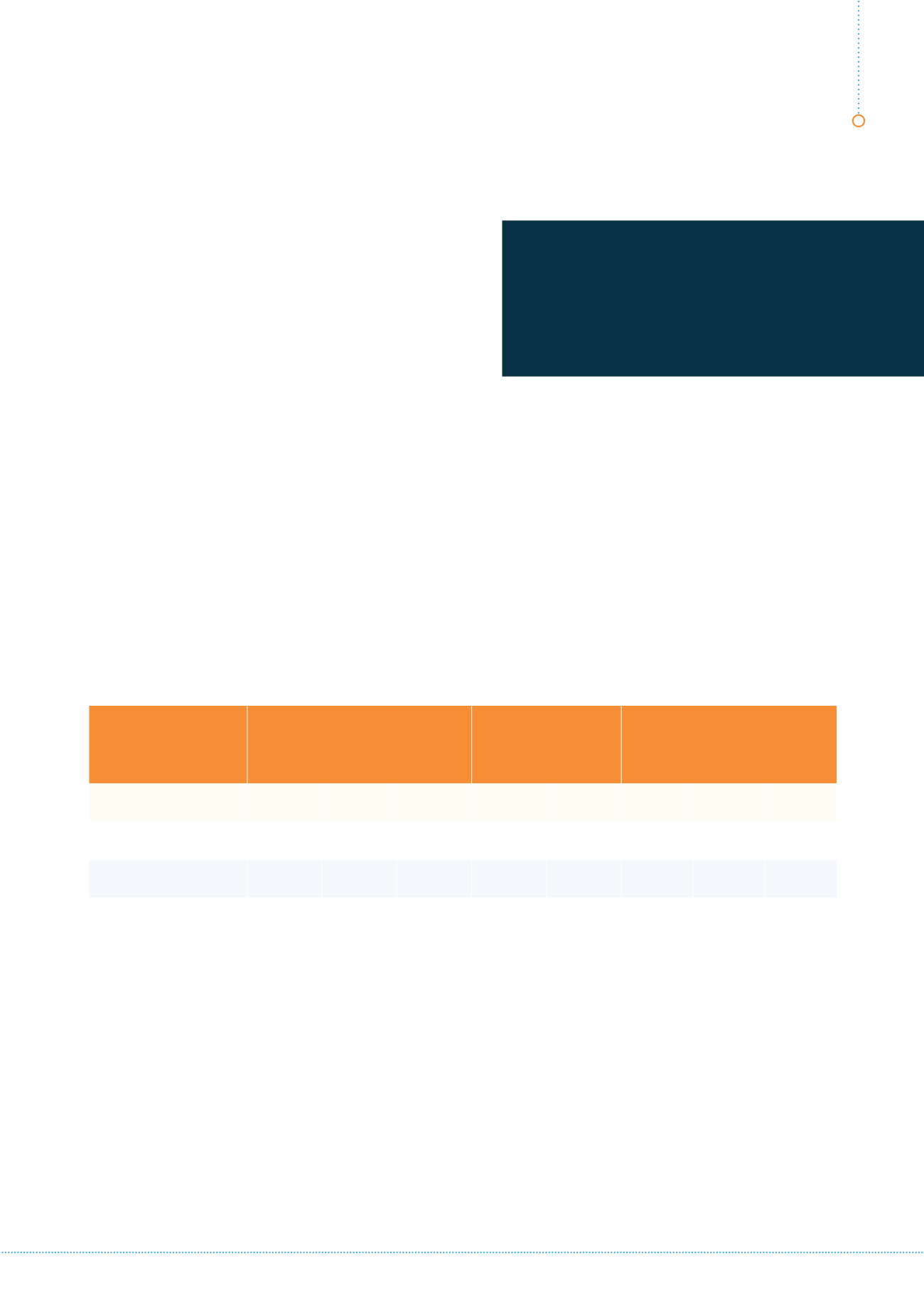

Comparison

groups

Value of fixed assets

on 31. December ……

in thousand EUR

Depreciation in

thousand EUR in

year ……

Investments

in thousand EUR

in year……

2009 2010 2011 2010 2011 2009 2010 2011

Hotels

1.772 1.721 1.804 170

160

90

119

243

Hotel garni*

672

651

674

86

82

64

65

105

*Hotels without restaurant Source: dwif e.V.

The VAT reduction for accommodation services has also paid off for the Treasury in Germany - even without

taking into account any economic multiplier effects. According to the VAT tax statistics published by the German

Federal Statistical Office - the VAT revenue in the hotel industry rose by EUR 72.8 million to EUR 3,493 billion in

2015 compared to 3,420 billion in 2009, the year before the VAT reduction from 19 to 7%.

In

Ireland

, the Irish Hotels Federation estimates that there has been a 79% increase in activity covered by the 9%

Vat rate since 2011, following the reduction from 13.5%.

33

This increase means that annual VAT receipts to the

exchequer relating to this activity are now €202 million more than in 2011.

“The VAT reduction paid off for the

Treasury, too: The total VAT revenue from

the German hotel industry in 2015 was

already higher with a 7% rate than it was in

2009 with a 19% rate”

Mr. Otto Lindner, President of IHA-D

HOTREC - Report on the benefits of low VAT on job creation and competitiveness in the European Union

|

17