2018

|

2019 HOTREC ANNUAL REPORT

|

21

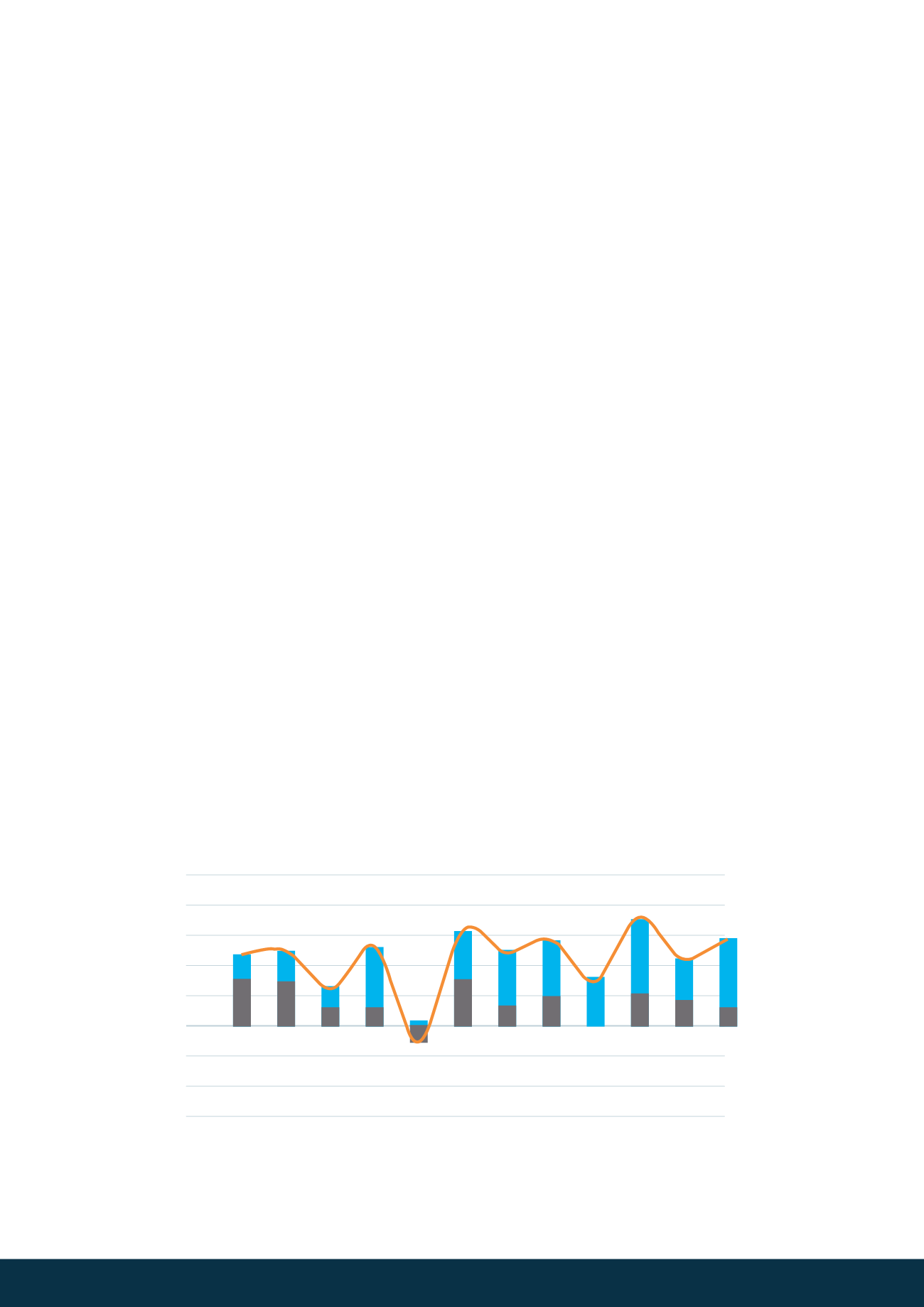

10%

8%

6%

4%

2%

0%

-2%

-4%

-6%

01/18 05/18 03/18 04/18 05/18 06/18 07/18 08/18 09/18 10/18 11/18 12/18

Austria and the Netherlands both posted moderate growth in their occupancy rates, which were already at

mature levels, to 78.1% (+1.2 points) and 79.0% (+1.1 points) respectively. With economies in fine fettle boosting

the arrivals of business customers and cities with cultural offers that European tourists are fond of on weekends,

hoteliers are able to better fill their properties throughout the week and at the same time increase their prices,

which jumped by 5.0% in the Netherlands and 6.3% in Austria. In addition to Luxembourg, the Netherlands has

the highest RevPAR in Europe at €92.6.

The Duchy, whose main foreign visitors are tourists from neighboring countries, and especially Belgium, Germany

and France, saw its occupancy drop by 1.8 points, but nonetheless remain at a high level (76.8%). The increase in

its prices (+6.4%) enabled its RevPAR (+3.9%) to cross the three-digit mark to €101.5.

Its neighbor Germany struggled to increase its occupancy rate (+0.4 points) and saw its prices rise by +2.2%,

which was smaller than the European average (+3.3%).

The United Kingdom is in the same situation with moderate increases compared to European averages, although

it should be noted that its levels are among the highest on the continent. British occupancy thus exceeded 80%

and average daily rates were higher than €100.

Belgium’s hotel industry had started last year, signing +13.9% growth for RevPAR after the annus horribilis of

2016. The kingdom continues to build on its momentum with an 8.5% increase in RevPAR. It should be noted

that its occupancy rate has increased by nearly 10 points in just two years, from 65.8% in 2016 to 75.2% in 2018.

In the Mediterranean region, two situations stand out

On the one hand, Greece and Portugal growth in hospitality in Europe with RevPARs leaping by 14.7% and 18.8 %

marked by positive growth in OR and a bound in their ADRs. In 2018, ADRs continued strong growth – by + 9.1%

in Greece and + 4.2 % in Portugal – but both lost half a point in occupancy.

On the other hand, Spain and Italy made more moderate progress with RevPAR increases of +1.5% and +3.1%.

Central Europe

Finally, while Hungary performed well (RevPAR +10.2%), the Czech Republic and Poland posted lower growth

than other destinations with RevPAR growth by just +0.6% and +0.7%. Prague stagnated (+0.1%) due to falling

prices (-0.5%) and most Polish cities saw their RevPAR fall in these uncertain times: Warsaw (-2.3%), Gdansk

(-2.9%), Wroclaw (+4.2%) and Szczecin (-4.9%).

■

Changes ADR

■

Changes OR

―

Changes RevPAR